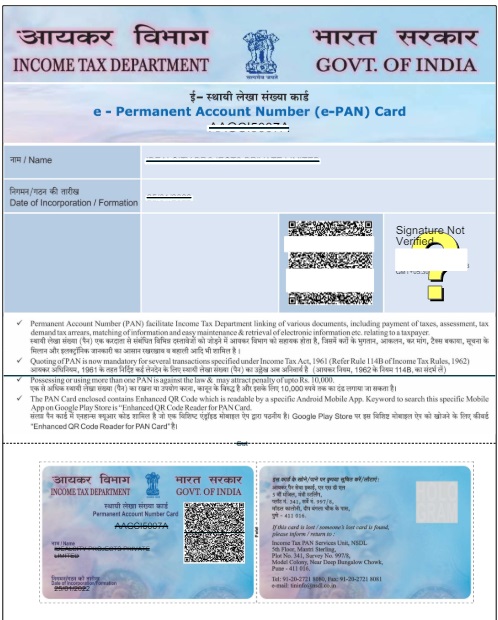

e-PAN

e-PAN facility is for allotment of Instant PAN (on near-real time basis) for those applicants who possess a valid Aadhaar number. It’s acrucial proof of identity for individuals and entities in India.

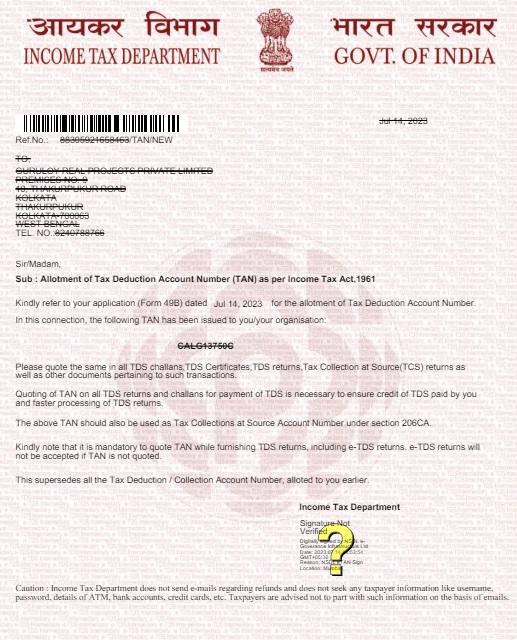

e-TAN

TAN stands for tax deduction & collection account number. It’s alphanumeric code that is issued to individuals or entities who are required to deduct or collect taxes on behalf of the Indian govt.

New PAN

A PAN Card, which stands for Permanent Account Number Card, is a unique identification card issued by the Income Tax Department of India. Its best to apply offline through 360 Degree Consultancy.

PAN Correction

A PAN Card is required to file Income Tax Returns, and it is important that all the details on the card are updated and correct. Read this article to know what are the steps to apply for PAN Card Update/Correction

Verify PAN

PAN card verification is a crucial process for all Indian citizens. The PAN card provided by the Income Tax Department works as the unique identifier of an individual. It helps in different financial activities.